📚 node [[convertible notes]]

What does it allow us to do ?

- It can let me invest into Codex without having to valuate and decide on the equity for now

- It lets us wait until the [[priced round]] when another investor would want to invest with a certain valuation in mind.

- At that point , the convertible notes get triggered and hence the first investor gets the [[Shares]] before the new investor .

How does it compensate for the higher risk that the early investor took ?

- It gives interest on the provided investment and also a discount on valutation .

- These both are to be agreed upon before closing the deal on the convertible notes

-

General , interest rate is 5-6% , while the discount could be from 10-25%

- More on this at https://youtu.be/njx09wXb9o0?t=623

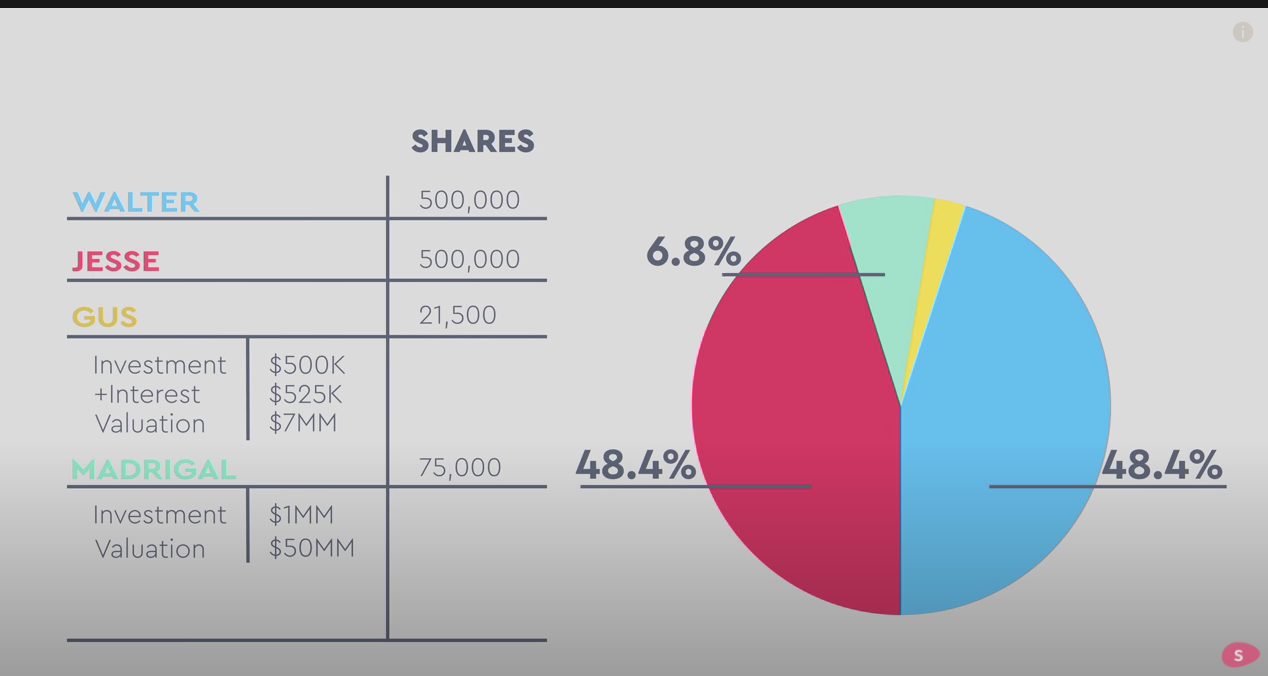

- Ex : if i invested 10k $ , if the priced round happens after one year , my investment would be evaluated as 10.5 -10.6 k , rather than the original 10k and also if the [[valuation of the company]] is at 1 M $ , for me it would be valuated only at 75k $ .

Limitation :

- This wouldn't compensate enough for the risk , the early investor took , if there is a very high valuation and if the initial investment was small (comparitively)

- Solution -> Putting a cap on maximum valuation !

What happens if company doesn't grow ?

to research :

- CAFE ^e2be26

- SAFE ^66a514

📖 stoas

- public document at doc.anagora.org/convertible-notes

- video call at meet.jit.si/convertible-notes

⥱ context

← back

(none)

(none)

↑ pushing here

(none)

(none)

↓ pulling this

(none)

(none)

🔎 full text search for 'convertible notes'